How CRM Helps Insurance Brokers Improve Business Performance

Table of Contents:

A sales-focused CRM can help improve business performance for insurance brokers. It helps with prospecting, data quality, renewal rates, measuring effectiveness and many more.

In a previous post, we had examined key problems facing insurance brokers and how to best overcome them, exploring areas like customer experience and undefined sales processes.

Now more than ever, it is vital for insurers to deliver a compelling and consistent customer experience, maximize sales from their client base and streamline their workflows.

In this article, we turn our attention to how a sales-focused CRM can help improve business performance for insurance brokers.

1. Improved Prospecting

Not so long ago, the prospecting process for insurance leads used to consist of a mixture of door to door sales and cold-calling, making predictability incredibly difficult. Maybe the salesperson would convince the prospect to buy. Maybe not.

And unfortunately, the high-pressure nature of such sales processes resulted in high-pressure sales tactics.

Today, however, it’s a whole different story. Insurance brokers are well adept at utilizing every available lead generation tool they can, presenting a clear and compelling value proposition. But now brokers face a different set of challenges.

After all, if they are selling more, they must enter more data. And if they must enter more, they have less time to sell. How can they optimize their time whilst juggling lead generation, compiling their prospect data and information and still finding time to sell?

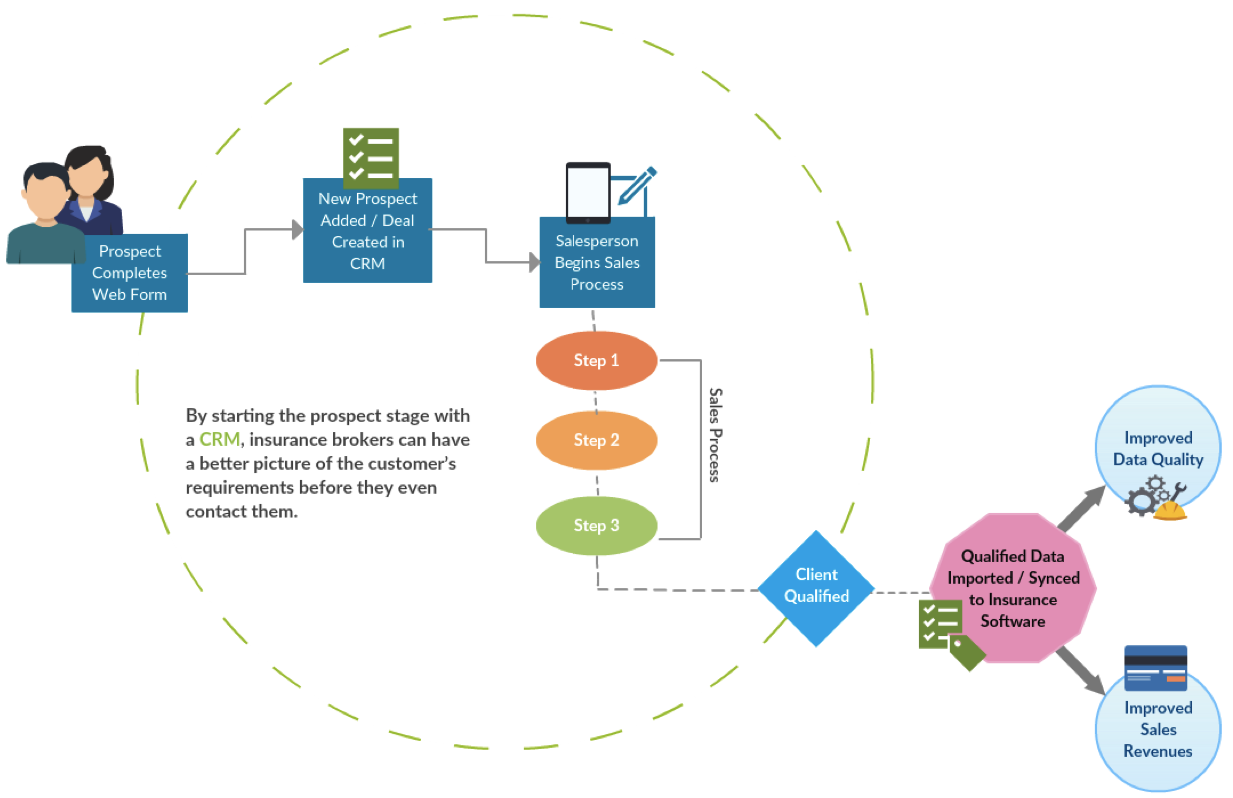

Simple – CRM data capture and automation. By integrating your CRM into your website contact forms, your inbound prospect data goes directly into your CRM and into your sales funnel, rather than simply as an email to your inbox with some contact info.

Data automation within your CRM can eliminate up to 5.5 hours per week of manual entry for each sales rep, making your CRM system easier to use and minimizes the time restraints to keep your CRM data up-to-date.

CRM’s are, after all, designed specifically to save time and improve sales processes – so be sure to make the most of yours.

2. Better Data Quality

Data quality can be assessed in numerous ways. Whether it’s checking for data accuracy, managing duplicate contacts, or checking for incomplete/missing fields.

Putting your data at the heart of your business and allowing your team to base their decisions on real-time information, helps give them a better understanding of customer behavior – when, how and why they interact with your team — meaning they can offer a more personalized service, pre-empt problems and tailor their products and offers in response to changing needs.

Start by considering how your sales-team will use the CRM and the data entered, and indeed, which data is most relevant.

If they have to fill 100+ different fields before they can progress to the next stage, likelihood is the data will either be garbage, or the salesperson simply won’t adopt that process till they know it’s a sale – meaning an inaccurate view of your pipeline and an inability to forecast properly.

Accurate & relevant data for your sales team means they can better qualify their prospects and move them through the sales process more effectively.

By separating lead and prospect data from the client data in your insurance software (Acturis, SSP Pure), you ensure not only better quality data in your insurance software, but also a more efficient sales process.

The qualified sales lead can then be imported/synced to the insurance software accordingly.

By employing such processes, and utilizing the right tools in the right way, insurers can optimize their time and performance through accurate data-driven sales.

3. Integrating Your Back & Front Offices

Treating your front of house and back offices as two separate operations may be good for certain styles of management, however, it’s not conducive for maximizing sales potential. Removing any barriers between front and back offices helps provide companies transparency across their entire business, giving a clear view of the customer journey and lifecycle.

Fencing or redacting sensitive data where needed ensures the business remains GDPR compliant, but by compiling all transactional data and historical information, sales teams can provide a much more personalized, tailored approach. And providing accurate notes have been made throughout the customer journey, salespersons will also be able to see any blockers or barriers to the sale and pre-empt them accordingly.

For example, if a broker is renewing an insurance policy for a return client, they will be able to use existing back-office data to better understand what coverage they currently have and where there may be gaps you can fill with relevant products.

Sales teams may also utilize existing data to uncover the types of coverage a particular group has and look for potential opportunities. Based on this information, he or she can begin to identify segments of customers who have gaps in their coverage, or who may be exposed to certain risks, and up-sell a coverage that makes sense for their particular situations, i.e. a person recently purchasing auto insurance for a family sized car may also be a good candidate to upgrade their life insurance as well.

With a well-organized and intuitive platform, and contact data properly grouped or segmented, sales reps can easily replicate this entire process. Simply filter your contact list by a particular product or policy, add the additional filters needed (claims history, valuation etc.), and once you have your targeted list, you can begin your sales / up-selling process.

4. Improving Renewal Rates

A common pain point for insurance businesses is lost renewals. And this is particularly important when considering acquiring a new customer is five times as expensive as retaining an existing customer.

When it comes time to renew their policies, clients will invariably start shopping for a new or better deal. And if the insurer forgets or neglects to contact the client before their policies lapse, then the likelihood of them moving to another insurance provider is that much higher.

However, with automated reminders and tasks built into the sales process itself, retention and renewal ratios can increase significantly.

Plan renewals into your sales cycle and calendars, even as the first policy is being completed. Start by mapping your customer’s life-cycle, from initial contact through to consideration, purchase, use & renewal. What does this journey look like? What are the key milestones and when are they? And what factors may influence the renewal?

An example workflow may look like this;

- Day 0 – prospect purchases insurance policy for 1 year.

- Day 0 – automated calendar reminder is added for 275 days time (90 days before policy ends).

- Day 275 – automated email template is sent to client reminding them of upcoming renewal date with relevant links/info.

- Day 305 – automated task appears in salespersons calendar reminding them to make a ‘Renewal Call’ to the client.

- Day 335 – 2nd task reminder appears in for ‘Renewal Call’.

Even part-automation on this process can help cut down on manual data entry and reduce the amount of paperwork agents have to do while streamlining redundant processes.

Delivering well-timed, proactive and targeted communications to provide relevant information (based on the customer’s life cycle), will help make clients feel valued that much more. Do they prefer SMS to email? Or do they favour email over a phone call? Offers combined with service reminders and other pertinent information will likely make for happy customers.

5. Measuring KPI’s & Effectiveness

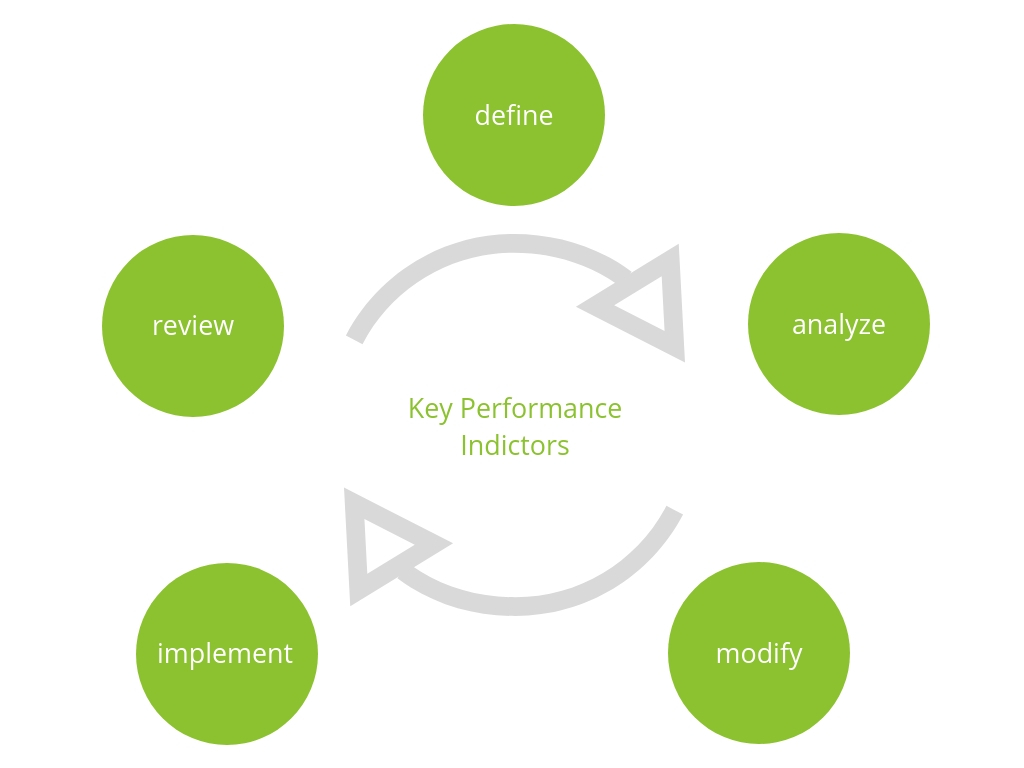

Your CRM data can help provide some powerful insights into the effectiveness of your sales processes but before you can begin iterating processes or system, you need to create a baseline of current business performance and manage upward from there.

The simplest method is to use key performance indicators (KPIs).

KPI’s are important metrics that allow you to objectively assess the effectiveness of your operations. They provide valuable information on whether the business is going in the right direction, indicate which elements could be improved or reveal weak links in the processes. The correct determination of indicators measuring sales may prove to be crucial for the functioning of the entire organization.

So first determine which indicators are right for your sales team and which will help you reach the goals set for your organization? Good to ask yourself, why do you want to measure those particular KPI’s? This will help ensure all of yours and your teams’ actions are geared toward the same goal.

So how do you decide what to measure? Here are a few examples of what could be measured to help boost business performance;

- Revenue per policyholder; the revenue generated by the insurance company per policyholder served. A low or lagging value could indicate poor sales results, or below-par customer service, which will, in turn, affect customer retention rates.

- Sales Velocity; sales velocity measures how fast you’re making money. It looks at how quickly leads are moving through your pipeline and how much value new customers provide over a given period.

- Sales Cost to Sales Volume Ratio; measure the total cost of your sales efforts in a month vs the total sales volume generated in that month. Then convert that to a ratio and express it as a percentage.

- Average Retention Rate; measures what percentage of your customers cancel each year/month (or whatever is most appropriate for your business).

Now more than ever, it is vital for insurers to deliver a compelling and consistent customer experience, maximize sales from their client base and streamline their workflows.

Insurance is a particularly specialized product, relying heavily on close customer interactions. Employing a sales-focused CRM is an excellent method for increasing understanding of potential and existing customers, and thereby enabling agents to provide unique services according to their individual situation.

By starting this journey at the prospect stage with CRM, insurance agents can have a better picture of the customer’s requirements before they even contact them.

By removing the unnecessary layers of complexity and focusing on the key metrics to help drive business performance, insurance brokers will seldom face a challenge he or she cannot readily overcome.

Other posts

Guide to Sales Metrics: 14 Examples

What is the Role of a CRM System in Your Sales Cycle?