6 Challenges Facing Insurance Brokers & How to Overcome Them

Table of Contents:

And while improving economic conditions may have brightened the short-term outlook for some, for many insurers, the changing landscape presents a whole new set of issues. In this article, we look at 6 keys problems facing insurance broker and how to best overcome them.

In this article, we explore the challenges of:

- Customer Experience

- Workflow Efficiency

- Lead Generation

- Uncertainty in the Market / Brexit

- New & Emerging Risks

- Undefined Sales Process

Challenge #1: Customer Experience

In recent years, customer experience has fast become a top priority for businesses, with 86% of buyers stating they are willing to pay more for great customer experience. The insurance sector is no different, with customer experience emerging as a ‘make or break factor’ for many insurers.

As consumers are becoming more & more informed, they ultimately expect a better level of service and a more personalized experience. Approximately 64% of consumers say they are likely to carry out research online before making any purchasing decisions, while a whopping 94% say an online review has convinced them to avoid a business or product.

Insurance brokers, therefore, need to fill any disconnect between customers and producers, delivering a unique, consultative and high-value experience to each of their customers, whilst being able to assert their value terms of helping customers meet certain financial requirements and overall financial wellness.

Solution:

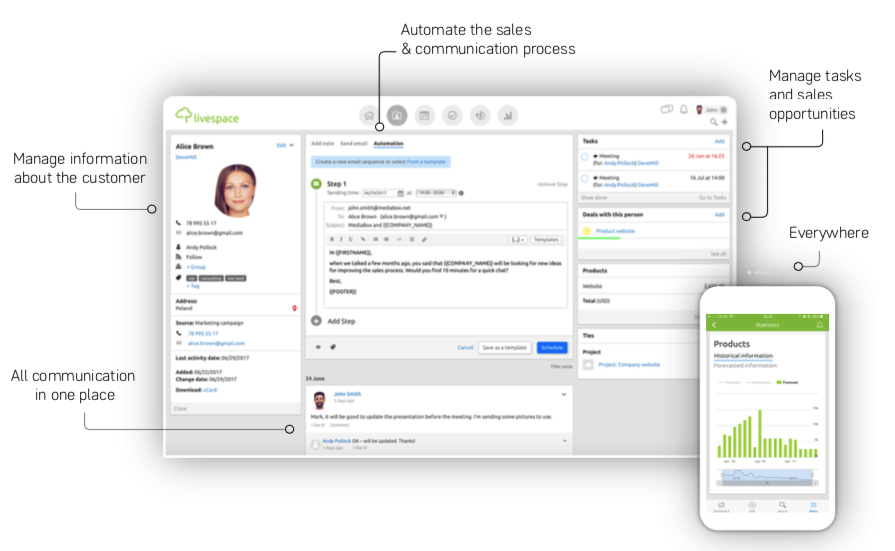

Whether it’s a client portal or a comprehensive internal platform, the ability to be able to view a customer’s historical data will allow brokers to better meet their client’s needs. Having a customer’s personal circumstances, previous emails & notes, as well as personalized financial advice or information means every customer can receive a ‘personal touch’.

A CRM for example, allows you to track your entire customer journey, from initial interest and contact, into the sales process, through to customer success teams, follow-ups & marketing engagement.

Combine this with existing software’s, and you have a platform that allows you to collate all of your customer data, review your processes and actions performed against each other, whilst allowing room for adaptable change – making for an ideal customer service solution.

Challenge #2: Workflow Efficiency

As technology improves and continues to change, so too does the nature of the business. Now more than ever, insurance brokers need to continually evaluate the way in which they define and manage their workflows and processes if they hope to combat slower growth projections and prosper.

Legacy tech and out-of-date organizational structures, combined with siloed departmental data, can leave a lot of brokers playing catch up. Searching on one platform for client information and processing the next steps on another.

As a result, productivity and motivation can be affected – performing the same tasks, 5 times a day, every day for example – there must be a more time efficient and indeed, agent-centric solution. And whilst certain actions may be trickier to automate, (i.e. an underwriter’s qualitative analysis), other day-to-day actions can easily be automated, freeing up time to focus on other areas.

Solution:

Automate those repetitive tasks and processes and free up valuable time.

A study from the Harvard Business Review showed that even simple digitization of existing processes could help insurance companies deliver up to a 65% reduction in costs, a potential 90% reduction in turnaround time on key processes, and perhaps most interestingly, improve conversion rates by more than 20%.

A well-defined, intuitive process will allow companies to maximize their time, and ultimately their productivity, in an actionable way, helping businesses to maintain an adaptable strategy, make informed decisions about any bottlenecks they may have, improve efficiencies, and book more business.

Challenge #3: Lead Generation

Selling insurance services comes with its own unique set of challenges when it comes to lead generation. In areas such as life insurance or retirement planning, a certain degree of reticence can be seen when consumers are investing in such definitive products.

And now more than ever, buyers are more inclined to review insurance services either online, directly on the website or through a price comparison site. But with consumers having to navigate a ton of options and work out what coverage best suits their needs, wading through all those possibilities can be an exhaustive task

Add to this the recent changes in data processing and GDPR, and the prospect of lead gen. for insurance broker can seem all too much.

Solution:

By now, all insurance brokerages are (or should be) GDPR compliant. Since you are dealing with prospect or customer information, it is your responsibility to keep their data safe, as well keeping them informed about when, how and where you plan to use their information.

But GDPR doesn’t mean you can’t continue with your lead generation – you just need to refine the process of how, when & where you use the data and have a legitimate reason to contact them. Lead generation is a key component of any business. Something as simple as maintaining a business blog is one of the best ways for your business to attract new customers, so good to ensure your content is about solving problems for your customers, and not just talking about what you do.

To get the most from your lead gen. strategy, it’s worth taking some time to examine what you’re doing currently. Which area isn’t working so well? Have you got a current and informative blog? Are you utilizing social media effectively? Where are you advertising? And is that where your target audience and prospects are actually spending their time?

And of course, do you have an effective referral strategy? (referrals generally being the fastest way to get your lead generation back on track). Based on the above, you can begin to make the necessary changes.

Challenge #4: Uncertainty in the Market / Brexit

As emphasized by the 2018 theme of the British Insurance Brokers’ Association, “Innovate, Evolve, Thrive” – a constantly changing market demands that brokers commit their resources to understanding and adapting.

With Brexit looming, the biggest risk for brokers in the U.K leaving the E.U is that Britain could lose its passport rights, to freely underwrite policies and insure across the European borders. As such, this could have a direct impact on commercial brokers bottom line, with clients potentially scaling back their operations as a result of both short-term uncertainties, as well longer-term difficulties in accessing and trading with European markets.

Add to this, the potential issues around compliance and restructuring (Solvency II), the future market following UK leaving the EU, continues to be a point of uncertainty for the insurance industry.

Solution:

Insurance brokers are facing significant challenges but their ability to overcome changing market dynamics is unquestioned. Organizational change seems to have become part of the daily conversation for brokers and embedding this in their culture will enable every member of the team to make a positive input.

For those UK insurers wanting to keep their passporting rights, they may choose to create a subsidiary company in the EU / EEA, or perhaps even acquire an existing business. There is also the option of incorporating or converting your company into an SE, a European public company.

These workarounds are not without their own challenges and uncertainties, however the positive in this instance is the robustness of Solvency II. Provided the UK maintains an equivalent to Solvency II, the infrastructure of such a framework is designed to withstand such financial shocks.

Challenge #5: Emerging Risks

From data misuse with Facebook and Cambridge Analytica to claims of election rigging in the political sphere, cyber-risk is no longer an emerging risk, but a new reality. In 2018, it was estimated that cybercrime can cost the global economy as much as $600 billion annually, with the financial sector at particular risk.

However, with little relevant historical claims data, predicting the likelihood for a claim being made, or calculating the maximum probable loss, is not that straightforward. It’s estimated that in the U.K, only 13% of cybercrimes are actually reported, meaning the failure to collect data on cyber-crimes is compounded by the reluctance on the part of many companies, to report when they have been victims.

With the average person in the UK now spending an entire day per week online, (and with estimates set to surpass that), it could be argued that cyber threats have become an ‘acceptable risk’. And with the list of emerging risks increasing all the time; driverless cars, IoT etc., consumers, brokers and many insurers themselves are grappling to understand the cover required and how to access it.

Cybercrime may be viewed as simply the “cost of doing business” however, the impact and reputational damage could end up costing businesses a lot more.

Solution:

In response to the increasing vulnerability of online businesses, regulators have moved quickly to help create cyber risk management standards. The IAIS (International Association of Insurance Supervisors) was scheduled to consider a revised application paper on cyber risk at its annual general meeting. The paper is based on the G7’s “Fundamental Elements of Cyber Security for the Financial Sector”.

At ground level, companies can begin implementing their own changes. Secure data storage, either on-premise or cloud-based, is a must.

Ensuring that policies and procedures relating to cyber-security are clearly communicated to staff, i.e. checking personal mail, downloading files, plugging in unauthorized USB drives, etc.

An effective email security solution, to help prevent malware, along with regular password updates or multi-factor authentication, and a damage control plan (how to respond when a staff member discovers a breach, who to inform, when and how to tell customers etc.) – will all go a long way in helping your business react and adapt as required.

Challenge #6: Undefined Sales Processs

Having an established workflow or even employing automated systems for data management and communication within your office, doesn’t mean that you have an optimized process for your sales strategy in place.

Whilst sales processes may feel implicit to you, others in your team may not be following the same actions on a day-to-day basis. A recent study from Vantage Point Performance and the Sales Management Association showed that there was a direct correlation between effective pipeline management and strong revenue growth – with companies showing at least an 18% increase in revenue growth between against those without a formalised process.

Solution:

Defining your sales process is crucial in helping your businesses grow. By eliminating much of the guesswork of managing leads and customers, smaller businesses can benefit massively from a defined sales process.

Clearly defined opportunities, at designated stages, allows team members to replace their guesswork with a series of easily observable phases, that can be tracked and measured across every stage of every process.

A well-defined process ensures all team members are fully aware of each stage of the sales process, the actions required along the way and what needs to be completed in order to progress to the next step.

Once you’ve built the right sales process and implemented tools to monitor it (most likely your CRM), you’ll finally be able to optimize it.

Creating and defining your first sales process or improving your current one is not overly difficult and brings with it, tangible benefits. A clearly defined process is vital in helping you ensure effective, repeatable & scalable results.

“If you can’t measure it, you can’t improve it.”

– Peter Drucker

Three simple and straightforward methods to help with your process optimization are;

i. A / B tests – divide your sales team into two groups, each group selling the same product or services, but with each following a different process. After some time, analyze the result and their effectiveness and choose the process that yielded the best results.

ii. Analysis of Activities – this involves observing how often certain activities in the sales process are performed and how it affects the winning or losing of deals, i.e. the percentage of deals won when a particular action is performed, versus the percentage lost when that same action is not performed. This is crucial in helping you understand which stage in the process has the most impact and which actions will ultimately lead to closure.

iii. Coaching – the most classic of methods. Simply put, in-depth interviews with your teams on how well the process works for them. It’s important to organize regular meetings where teams can discuss ideas for streamlining the process. If managing larger teams, or meeting one on one, it’s also worth bearing in mind your teams’ different learning styles and adapting your coaching method accordingly.

A B2B sales funnel hosted in a CRM system with hard numbers, leads and sales projections attached makes for a powerful tool in protecting and managing the growth of a company.

What Next?

Faced with these challenges, it is more important now more than ever, for insurers to deliver a compelling and consistent customer experience, maximize sales from their client base and streamline their workflows.

By removing the unnecessary layers of complexity, automating eligible processes, and making it easier for customers to interact with their brokers, the digitally empowered broker will seldom face a challenge he or she cannot readily overcome.

Putting your data at the heart of your business and allowing your team to base their decisions on real-time information, helps give them a better understanding of customer behavior – when, how and why they interact with your team — meaning they can offer a more personalized service, pre-empt problems and tailor their products and offers in response to changing needs.

Organizational change has to become part of the daily conversation for brokers and embedding it into daily practice will enable every member of the team to make a positive input.

Other posts

Guide to Sales Metrics: 14 Examples

Useful tools to structure and organize work in a growing company